This article first appeared in Freedom News under a pen name.

Stupidly I forgot my wallet and only realised when I went to pay for my coffee. I flashed a bundle of notes (three, count them, three, fivers) like some sort of king but the barista shook his head, “sorry, card only”. I told him I’d left it at home and tried again but he just gave the coffee to me for free and left me wishing I’d ordered a bagel to go with it.

It’s an odd feeling waving money at someone and they just won’t take it off you. More and more it’s getting harder to pay by cash. We are drawing ever closer to a society where every transaction is invisible to the human eye, but never forgotten in a matrix of data. This is not a good thing.

Personally I’m not worried if Big Brother knows I bought a pasty at Greggs when it wasn’t even lunch time but I refuse to accept that we shouldn’t resist the decline of cash or even that the growing payment panopticon is a non-issue. While many seem relaxed about going cashless we need to think about what we’re losing, and who loses out the most.

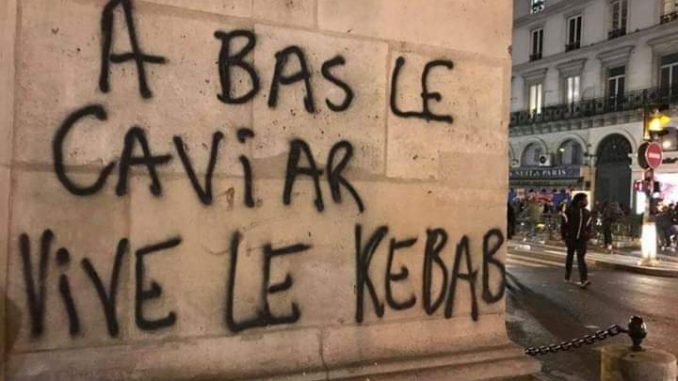

Sometimes advocating the cashless society goes hand in hand with sneering about builders or hairdressers taking cash to avoid tax. Small businesses avoiding card transaction fees is not an issue. Let’s face it if it was about avoiding tax Starbucks would insist on being paid in used fivers.

If we accept that Western governments are liberal and benign (let this slide just for now) none of us know what political futures lie in store for us in ten, twenty years time. When we’re living in a world where all of our payment history, our contacts and our activities can be traced in the minutest detail surely we cannot trust that this will never be misused, even if today the main outcome is getting push adverts for tents because I just bought a tent. I mean, I have one now, why would I want another? Is Occupy about to have another round of radical camping? No. Then just the one is sufficient, thanks.

And what is the impact of allowing cashless to become a norm for countries that are more plainly autocratic? Is it genuinely morally neutral for Bahrain’s “Economic 2030 vision” to propose an entirely cashless, traceable society? Given that that government’s response to the Arab Spring ten years ago was to gun people down in the streets and massively ramp up repression against those who’d see change – perhaps it’s not just about swiping for a latte.

Establishing norms here doesn’t just put us at risk of future dangers, for some those dangers are already here. When every transaction leaves a trace that can only be examined by the state and corporations it becomes a tool we are willingly handing to those who, sometimes, do not have our best interests at heart.

Mind you, the future might not be that far away in Britain. The Telegraph reported this week on discussion by the Bank of England that “digital currency could make payments faster, cheaper and safer, but also opens up new technological possibilities, including programming: effectively allowing a party in a transaction, such as the state or an employer, to control how the money is spent by the recipient.” They speculate that benefits could be paid in such a way “restricting the recipient to buying only essentials such as food with the money.” There are no such issues with cash.

https://www.telegraph.co.uk/business/2021/06/21/bank-england-tells-ministers-intervene-digital-currency-programming/

Let’s look at what it means for individuals on the ground. While some might find cashlessness convenient (and there’s no reason you shouldn’t) for others it becomes an obstacle to survival. For the undocumented, while banks are legally required to check immigration status of new account holders, the ability to be given cash, and be able to spend it, is vital to their survival.

I was speaking to a street homeless refugee a couple of weeks ago. He described to me how his family wanted to send him money, just to help him out of his situation, but because his only account was over the limit any bank transfer they made would simply go straight to the bank to fill that hole and he’d never see a penny. So while many homeless people find it impossible to get a bank account at all without valid ID and an address, even when they do their very poverty might make it useless just when they need it the most. If you’ve fallen into the cracks of our society eliminating cash removes a slender thread that could keep you alive.

If you’ve got one account and it gets closed down, everything is shut to you, including a cup of coffee or a bus ride, you’re hit with both having no money and no means of just being given a few quid to get home. For those whose accounts always have funds those are consequences they never face and so never see. That’s why the views of the comfortable are not always the most valuable voices to hear, despite their volume.

Abolishing cash does nothing to solve homelessness but it does make being homeless all the harder.

Of course some homeless people have card readers to combat the increasing “no spare change” they hear but even if you have a functioning bank account, the reader’s wifi needs to be paid for and working, your phone needs to be charged and the app has to work. Add to this that while many might be happy to pay by card to a Big Issue seller or Dope vendor, card readers themselves make it harder to ask for money as many think if someone has a card reader they clearly can’t be that badly off. It makes some worry that they are being scammed and not helping the hard up at all.

Like the people who once saw someone they thought might be a refugee holding a mobile phone and now they cling to it as evidence that refugees live the life of Riley, it’s based on rubbish. It doesn’t take the world to get a cheap pay as you go phone, that’s a drop in the ocean compared to a month’s rent or getting yourself on your feet, but it’s treated like it’s the preserve of merchant bankers and the elite and therefore an excuse to harden our hearts.

The card reader becomes a barrier between those desperately in need of support and those who might otherwise support them, nervous of a card transaction that’s not sanctioned by a brand name. Some are willing to exchange money but are wary of exchanging payment information. You can say, well these are bad people and bigots, that’s on them – but if it makes it harder to make a little bit of money on the street it’s neither here nor there if the would-be givers were imperfect.

At the risk of confusing solid political points with a desire to live in a world that has a soul… when I hand cash to someone who needs it it’s not just the note that we exchange. It’s also the chance for two people to feel human, there’s a glimpse of solidarity from both sides, it’s not just the money. There’s a recognition of each other’s existence in there – you don’t get that when you tap a reader.

It’s not just the homeless. Serving staff report people are less likely to tip when they can’t be sure the tip goes to the worker and moving everything to contactless payments makes it easier for the boss to simply pocket money people thought was going to staff. Sex workers who once used cash now find themselves using Paypal transactions that can be cancelled after the fact in a way that notes could never have been taken back.

Some companies have taken advantage of the pandemic to try to phase out cash. If your shop doesn’t take cash you’re deliberately making life harder for the most marginal, the elderly, and those who rely on the black economy and you are downright excluding others.

Just like with self service tills, gone are the days of emphasising customer service and keeping the public happy. We’re always dancing to the company’s agenda, forever squeezing into their mould until their desires become our normal. Refusing to take cash isn’t about serving the customer but cutting corners and shaping the future. The world’s systems are nowhere near as robust as we think so it’s not that rare for the wifi to go down or the card machine to stop working, and now the shop is closed for business regardless of how many notes you wave in front of someone.

As a retail worker I’ve never really enjoyed counting a pile of five pence coins as part of cashing up but the argument is not that cash is effortless but rather that the insubstantial nature of electronic payments comes at a social cost many don’t see until they find themselves pushed to the edges of society. And, as a society, if we don’t care about those who are struggling then we don’t really care about anyone at all.

This seems like a good moment to say that if you’re a shop worker you will not catch Covid from handling cash. Whatever understandable anxieties you may be feeling in these difficult times, if you’re regularly washing or sanitising your hands at work there’s no evidence people get infected handling money.

You need a union if your employer doesn’t let you have sanitiser by the till or, worse, makes you wear gloves which make a public show of precautions while in fact being worse than bare hands (you don’t catch Covid through the skin and no one washes gloves, so they actively discourage you from doing the one thing you should be doing). The odd grubby five pound note is far less of a threat to you than the commute to work, lax fellow workers or customers who think infectious diseases are a thing of fairy tales.

Let’s be clear, it’s not about whether we find it convenient. I’m not arguing for the abolition of cards, PayPal or whatever craptocurrency you’re into. You not carrying cash is not an argument to stop everyone else using it and importantly to stop people accepting it – it is the purest narcissism to think that something that suits you has to suit everyone else.

If we’re basing this on what we personally like, and we’re not, well then I find cash incredibly useful. The physical notes and coins help me ration my meagre funds preventing me from accidentally spending a whole week’s money in a few weightless swipes of a card. For some of us the lightness of electronic transfer is a mortal danger where a miscalculation can have unpleasant consequences.

Find cashless convenient? Fine. For some of us keeping cash as a preference is more than just a personal preference. You can say budget better, be more organised. I say this is exactly how many of us who are close to the line budget better, cash allows us to organise in a way that works for us, because we can hold it in our hands and see that we’ve overspent, or are able to treat ourselves.

When I use cash it’s clear what I’m spending and on what. Talking of nerves, with transactions where there’s a beep and it’s done, who’s to say if there was an error, who might fail to notice a mistake with invisible payments that might accidentally wipe you out a week later. Sometimes taking a month to find out there was an error can be a car crash.

You do you, but let me keep doing me.

I can see why corporations might like to integrate all my data, and synch that in with all the information they have on the people I interact with, in order to sell me things more efficiently. However, can they see why I’d like to disembowel their executives and drag their screaming bodies by the heels around the walls of The City until their weeping families come to me at night on bended knee begging for mercy? It’s all a question of choice I suppose.